Partner with MRP

MRP is the largest landlord of Walmart Shadow Center shopping centers in small-town America. With a focused niche, proven strategy, and over a decade of growth, we continue to scale this asset class to an institutional level.

Investing In America's Modern Mainstreets

MRP’s shopping centers are strategically positioned next to the primary grocer of the market and predominantly occupied by national credit retailers providing essential services. This asset class possesses proven resilience and the opportunity to create outsized value.

110+

Walmart Shadow Centers

Acquired

$420M+

Transaction

Value

3.5M+

Square Feet

in Acquisitions

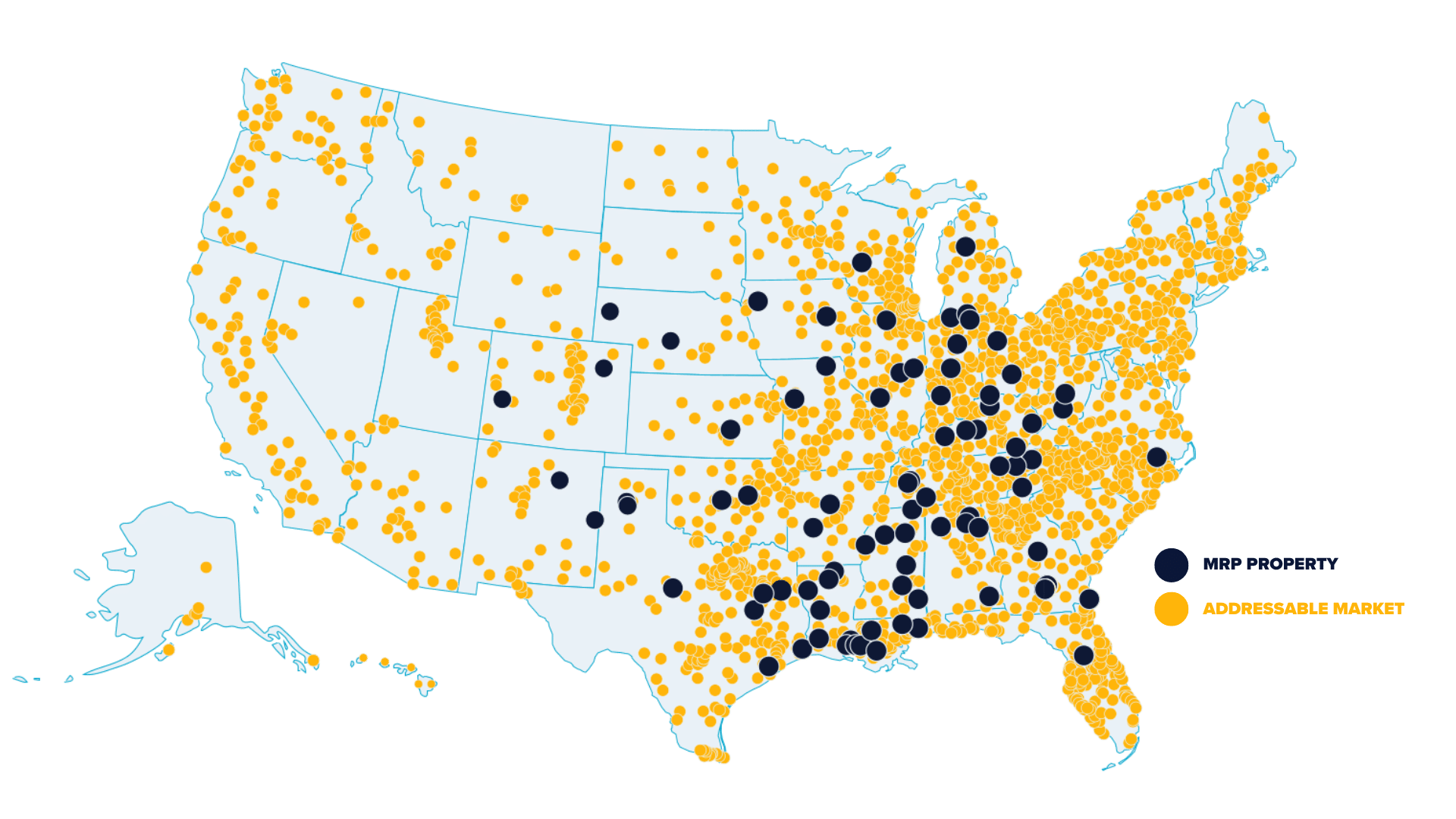

An Untapped Market Ready for Scale

There are 4,460 properties in 1,700 small towns that fit our investment model across small-town America.

Consolidation of this fragmented asset class is only being pursued by MRP.

Our current portfolio of 80+ properties is the largest in this niche yet represents less than 2% of the properties in the total market, underscoring the monumental potential for growth.

A Proven Framework for Property Selection

Market Criteria

We’ve developed criteria to understand the strength of the market, prove that the Walmart is high-performing and the largest grocer in the surrounding region, and that the retail area is the most densely trafficked in the region.

Property Criteria

We purchase properties with the ideal balance of stability and value-add opportunities – enough occupancy to ensure immediate value, with vacancies where national credit tenant partners will sign leases post-close.

Partners for Growth

MRP Capital Group is actively scaling this asset class to the next level.

To learn more about opportunities for partnership, download our Strategy 1-Pager below.